The Most Comprehensive Own-Occupation Definition of Disability for Surgeons

The Enhanced True Own-Occupation protection for physicians starts with the strong True Own-Occupation Definition of Total Disability. If totally disabled, you can receive your full disability benefits even if you’re gainfully employed in another occupation or capacity. And, while totally disabled in your own occupation, there may be instances where you can even work in your own practice and still collect your total disability benefit.

Plus more ways to qualify for benefits

Plus more ways to qualify for benefits

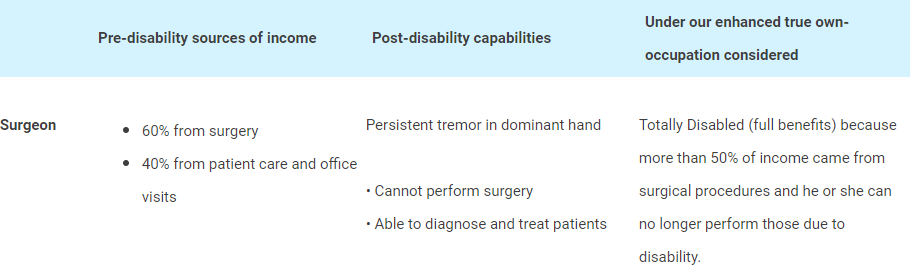

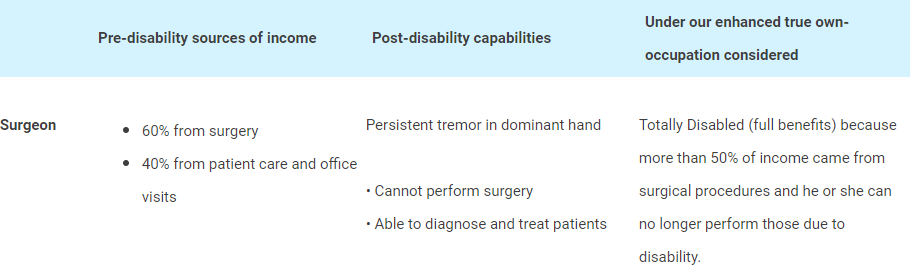

Then, they add a straightforward, easy-to-understand formula to qualify for benefits. It’s based on your source of earnings and provides more ways to qualify for benefits. They will consider you totally disabled if more than 50% of your income is from;

- Hands-on patient care and, solely because of injury or illness, you can no longer perform hands-on patient care or

- Performing surgical procedures and, solely because of injury or illness, you can no longer perform surgical procedures.

That’s not all. Suppose you don’t qualify for benefits under the source-of-earnings formula above. In that case, they will look at your key duties, including those you performed in your medical specialty when your disability began, to assess whether or not you qualify. Because they evaluate your situation from multiple perspectives, they give you more ways to be eligible for total disability benefits.

Guaranteed Standard Issue (GSI) Disability Insurance Programs for Residents and Fellows

Guardian has more GSI disability insurance offers nationwide than any other insurance company. If you are a Resident or Fellow, you should always apply for the GSI offer at your hospital if one exists. If you make the mistake of applying with another company first, you could quickly become ineligible to use the Guardian GSI offer. There is never a good reason to apply with another company when your hospital has a guaranteed issue offer.

The following article has an extensive list of Guardian GSI disability insurance offers. You can also get a quote from that link, and your request will go to the endorsed agent at your hospital to handle the request.

Additional Options to Consider in a Disability Insurance Policy for a Surgeon

- Student Loan Rider - Many surgeons have significant student loans when they graduate. These are not always forgiven in the event of a disability. The student loan rider can reimburse your student loan obligations in the event of a disability so that your monthly benefit goes to protecting your family.

- Partial Disability Rider - Sometimes, you're not totally disabled from your occupation. Many claims are partial, where you work fewer hours or perform fewer surgeries. Under the Enhanced Partial Disability Benefit rider, if you have at least a 15% loss of income, you could receive a portion of your monthly disability benefit if you have included this optional rider on your policy.

- Future Increase Option Rider - This is important for new surgeons in residency or fellowship. It allows you to buy more disability insurance as your income increases without going back through medical questions or underwriting.

- Serious Illness Supplement - This feature pays you an additional 50% of your monthly benefit for the first 12 months of a total disability claim if your disability is caused by cancer, stroke, or a heart attack.

Plus more ways to qualify for benefits

Plus more ways to qualify for benefits