Definition of Total Disability

Feature value:

The choice to work in another occupation is yours.

The Definition of Total Disability is the core of any disability income policy because it is the key to determining your eligibility for benefits.

Our True Own-Occupation Definition of Total Disability provides you the ability to receive your full disability benefits, even if you’re gainfully employed in another occupation or capacity — with no reduction in benefits. So, if you have the energy, interest, and motivation to pursue another occupation while totally disabled in your occupation, our True Own-Occupation definition does not prevent you from doing so.

If you are a dentist or physician who has limited your occupation to the performance of a single dental or medical specialty, we will consider that specialty to be your occupation.

Other optional definitions:

• Two-Year True Own-Occupation

This definition of disability offers a two-year period of True Own- Occupation. If you’re still disabled after two years, your coverage converts to a Modified Own-Occupation definition of disability for the remainder of your benefit period. Modified Own-Occupation refers to when, solely because of sickness or injury, you’re unable to perform the duties of your own occupation, and you’re not gainfully employed.

• Two-Year Modified Own-Occupation

Another option is to simply have a Modified Own-Occupation definition for the first two years. If you’re still disabled after two years, your coverage converts to an Any-Occupation definition, which refers to when, solely due to sickness or injury, you’re unable to work in any occupation.

A Definition Just for Physicians

Feature Value:

Some of the strongest, most flexible protection a physician can get — this is not available anywhere else in the industry!

Our enhanced definition starts with our strong True Own-Occupation Definition of Total Disability. If totally disabled, it provides a physician with the flexibility to be gainfully employed, in some instances even in their own practice, and still receive total disability benefits.

Then, we add a straightforward, easy-to-understand formula to qualify for benefits. It’s based on the source of your earnings and provides more ways to qualify for total disability benefits. We’ll consider you totally disabled if more than 50% of your income is from:

• Hands-on patient care and, solely because of injury or illness, you can no longer perform hands-on patient care; or

• Performing surgical procedures and, solely because of injury or illness, you can no longer perform surgical procedures.

If you don’t qualify for benefits under the source-of-earnings formula above, then we’ll look at your key duties, including those you were performing in your medical specialty at the time your disability began, to assess whether you qualify.

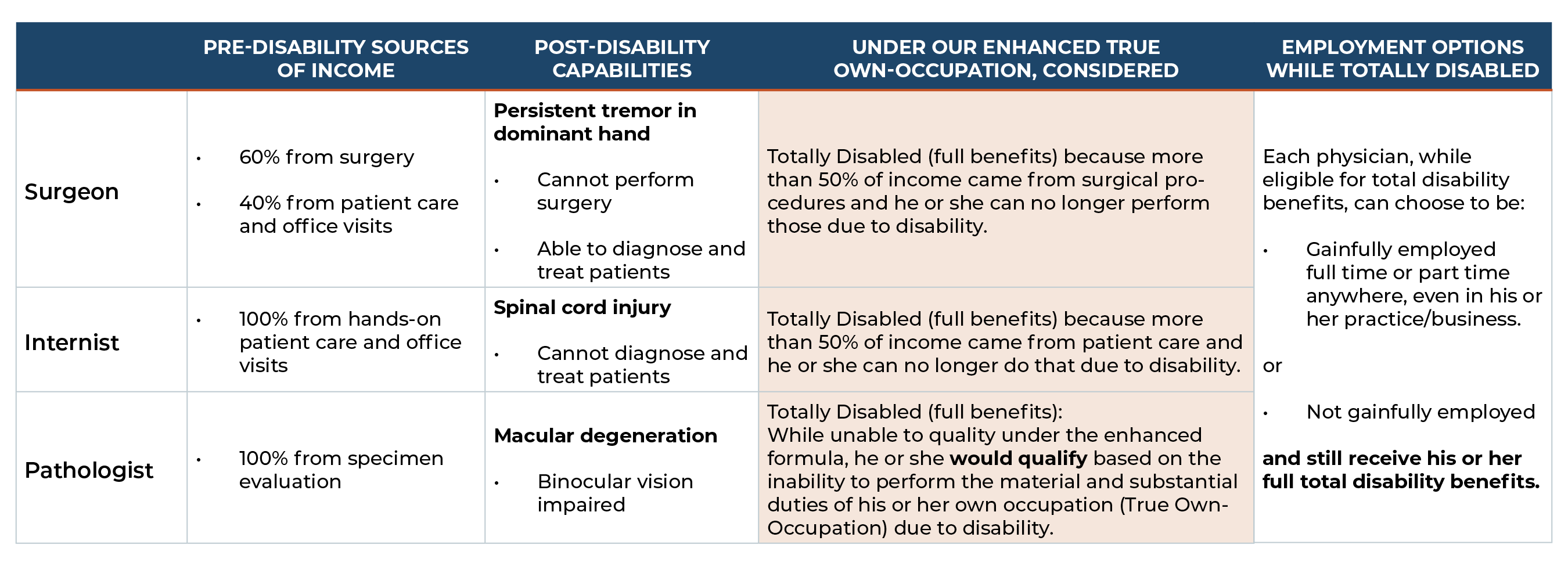

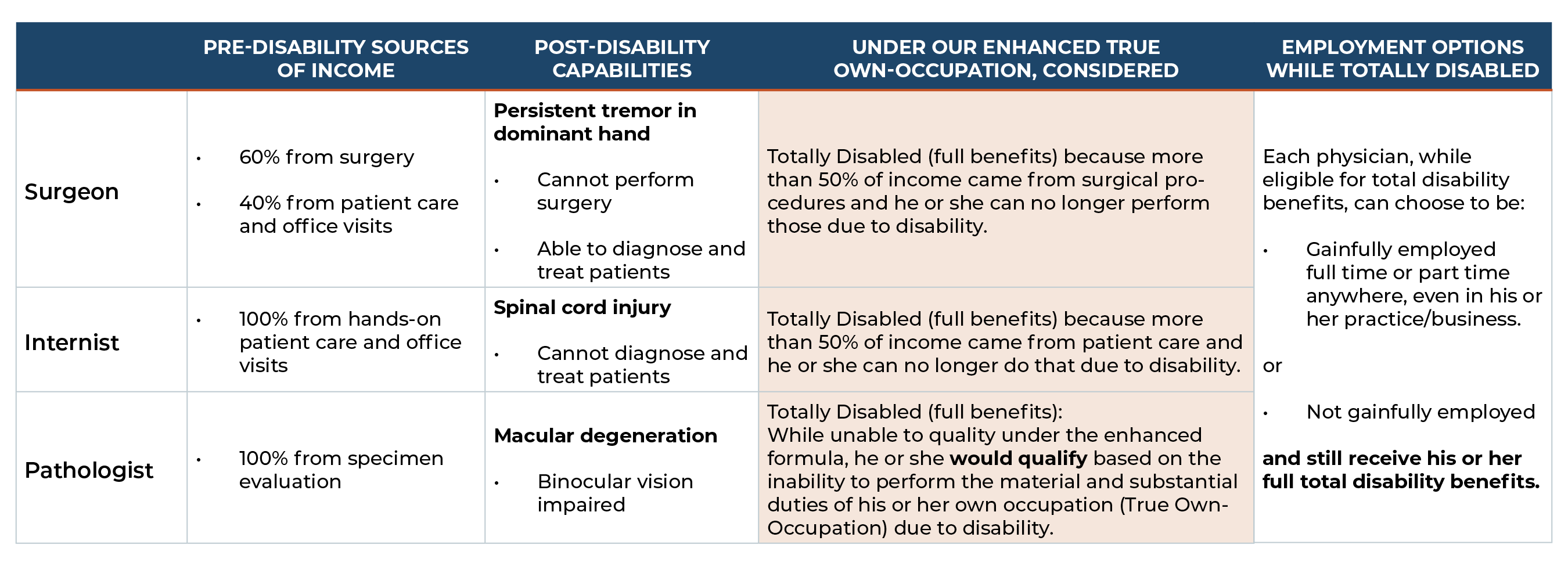

How it works:

See how three different physicians qualify for total disability. The first two qualify using the enhanced formula, and the third under a traditional assessment of how the disability affected his or her ability to perform occupational duties.

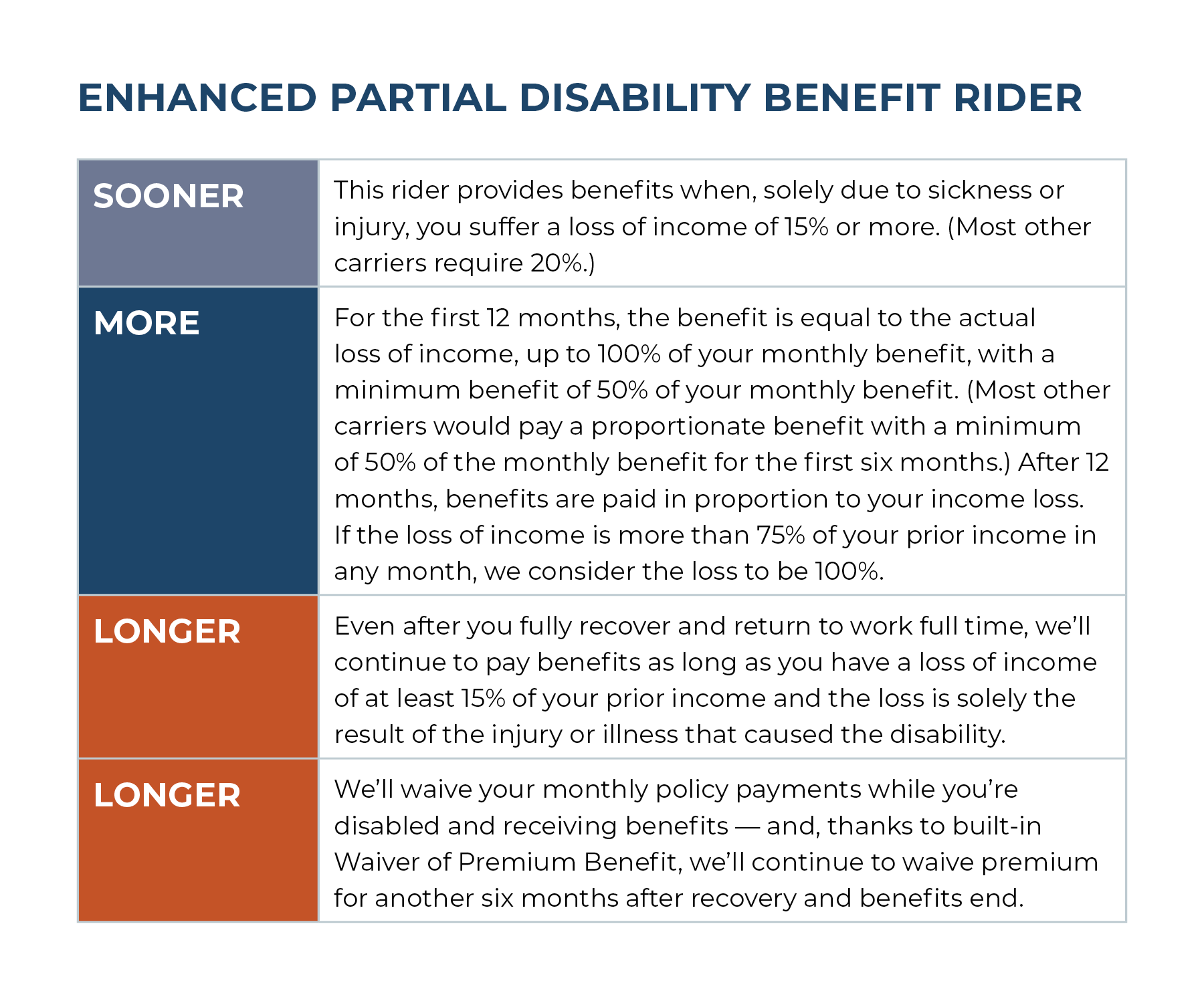

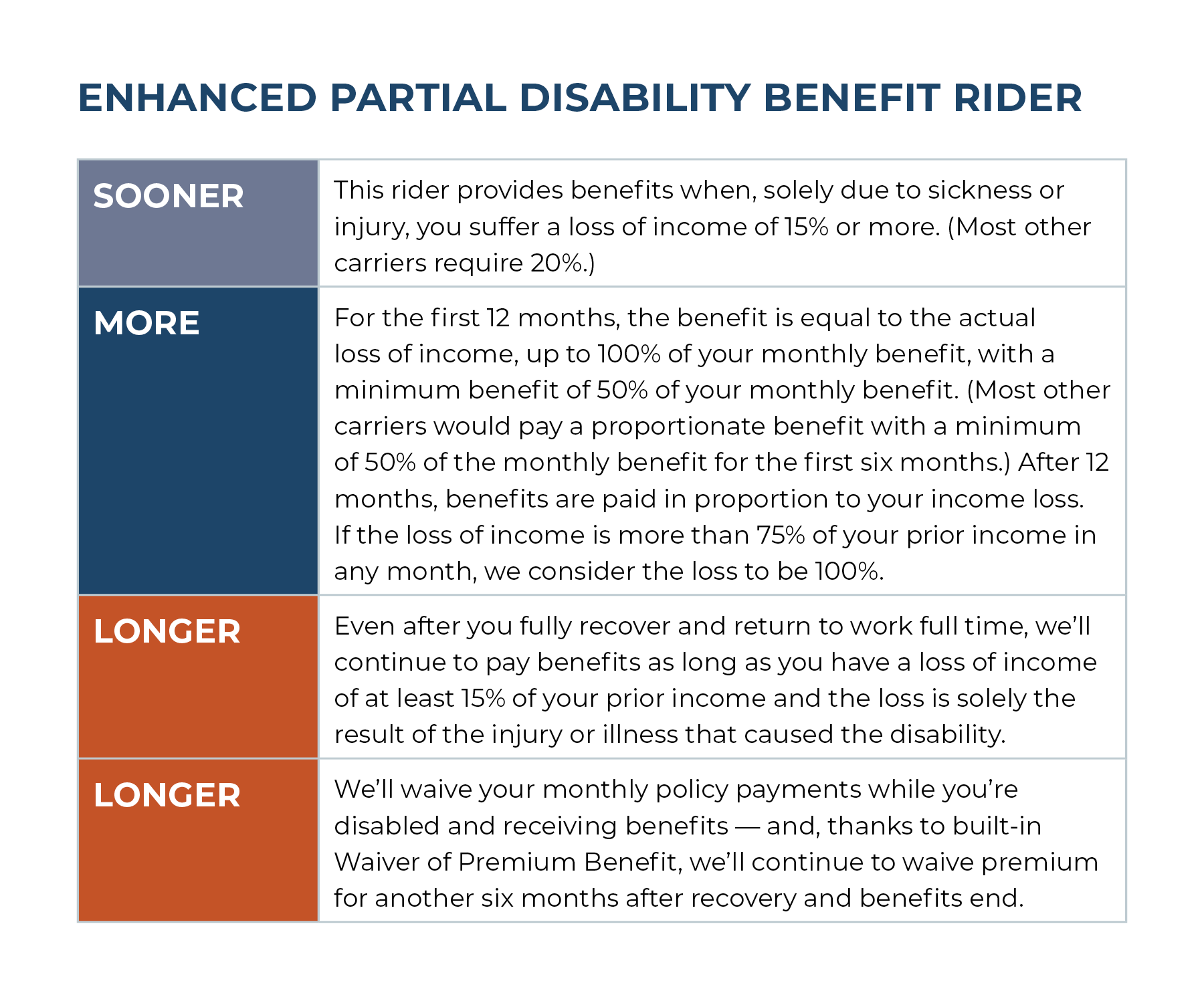

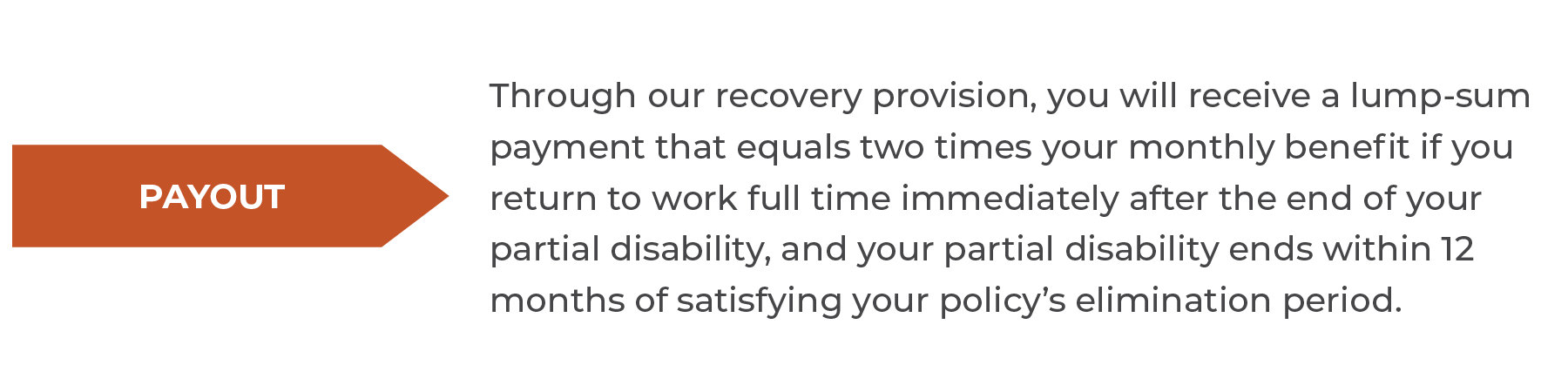

Enhanced Partial Disability Benefit

Feature value:

Delivers more benefits sooner and for a longer duration than most in the industry

Delivers more benefits sooner and for a longer duration than most in the industry

Sometimes a disability isn’t a “total disability” but prevents you from working full time, making it so that you’re unable to do the same tasks as before or it takes you longer to do them. Or, you may have recovered and are back to work, but you require time to get back to your pre-disability earnings.

We understand how important it is to get “back on your feet” after a disability. That’s why we offer two Partial Disability Benefit options (also known as riders) to help.

Basic Partial Disability Benefit

Feature value:

Helps you regain financial strength as you regain physical strength

Our Basic Partial Disability Benefit Rider provides benefits that support both physical and financial recovery.

Basic Partial Disability Benefit Rider

The partial disability benefit rider option provides benefits when you’re working, but your income is reduced by at least 20% as a result of the illness or injury that caused you to become disabled — and you’re unable to work as many hours or unable to perform all the same duties you did prior to your disability.

Benefits are payable in proportion to your loss of income, up to the policy benefit.

- If the loss of income is more than 75% of your prior income in any month, we consider the loss to be 100%.

- Plus, for the first six months, we’ll consider the loss of income to be at least 50% if you meet the definition of Partial Disability.

Student Loan Protection

Feature value:

Feature value:

Delivers additional funds to meet student loan obligations when you are totally disabled.

The effects of disability early on in your career — when student loan balances are at their highest — could have long-lasting consequences. Unlike other kinds of debt, under current law, federal student loan debt cannot be discharged during bankruptcy. It makes sense to safeguard your ability to continue loan payments during a period of disability.

Our Student Loan Protection Rider reimburses you for student loan payments — no matter how many you have, or how many institutions they’re with.

Additional coverage

Safeguard your ability to continue making your student loan payments with our optional Student Loan Protection Rider that lets you:

- Obtain additional coverage — up to $2,500/month1 — above what you might otherwise qualify for, based on your income

- Tailor coverage to your specific debt — reimburses $250-$2,500 per month toward student loan payments1

- Choose a rider duration — 10 or 15 years2

Adding this option is easy. No loan documentation is required at the time you buy your policy and/or this rider.

1 Reimburses $250-$2,500 per month toward student loan debt incurred from degree-granting institutions: up to $1,000 if pursuing or holding an undergraduate degree; up to $2,000 if pursuing or holding an advanced degree (i.e., degree beyond undergraduate); up to $2,500 for physicians (MD or DO).

2 This rider provides coverage for a period of 10 or 15 years from the policy date. When a qualifying total disability occurs, benefits are only payable during the remaining portion of the 10- or 15-year term that has not elapsed when the disability begins.

Options to Increase Coverage

Feature value:

Opportunity to increase protection as income grows — with no additional medical tests.

As your income grows, you may want to obtain additional coverage. Typically, that would require eligibility determined by your financial situation and evidence of good health (medical underwriting) each time you apply.

When you add either of the two options described below, you’ll be eligible to purchase additional coverage with no medical insurability requirement. This is a great way to ensure that you can protect your income, regardless of any changes in your health.

Each time that you apply to increase coverage, your eligibility is determined by your financial situation as assessed by your income, employment, and other disability income insurance.1

Choose one:

• Future Increase Option

This option provides the opportunity to increase coverage annually through age 55. It’s your choice whether or not to apply for additional coverage.

• Benefit Purchase Option

This cost-effective option gives you the opportunity to increase coverage every three years until age 55. You’re required to:

- Apply for additional coverage every three years.

- Purchase at least 50% of the amount of any additional coverage offered in order to keep the rider in effect.2

Assuming 3% annual increases, a 32-year-old making $100,000 per year today would earn about $6.9 million by the time they’re 65 years old. Shouldn’t that multimillion-dollar asset be insured?

1 All other disability income insurance that you own, have applied for, or for which you are eligible with any insurer.

2 You cannot use the Benefit Purchase Rider to add coverage while you are disabled.

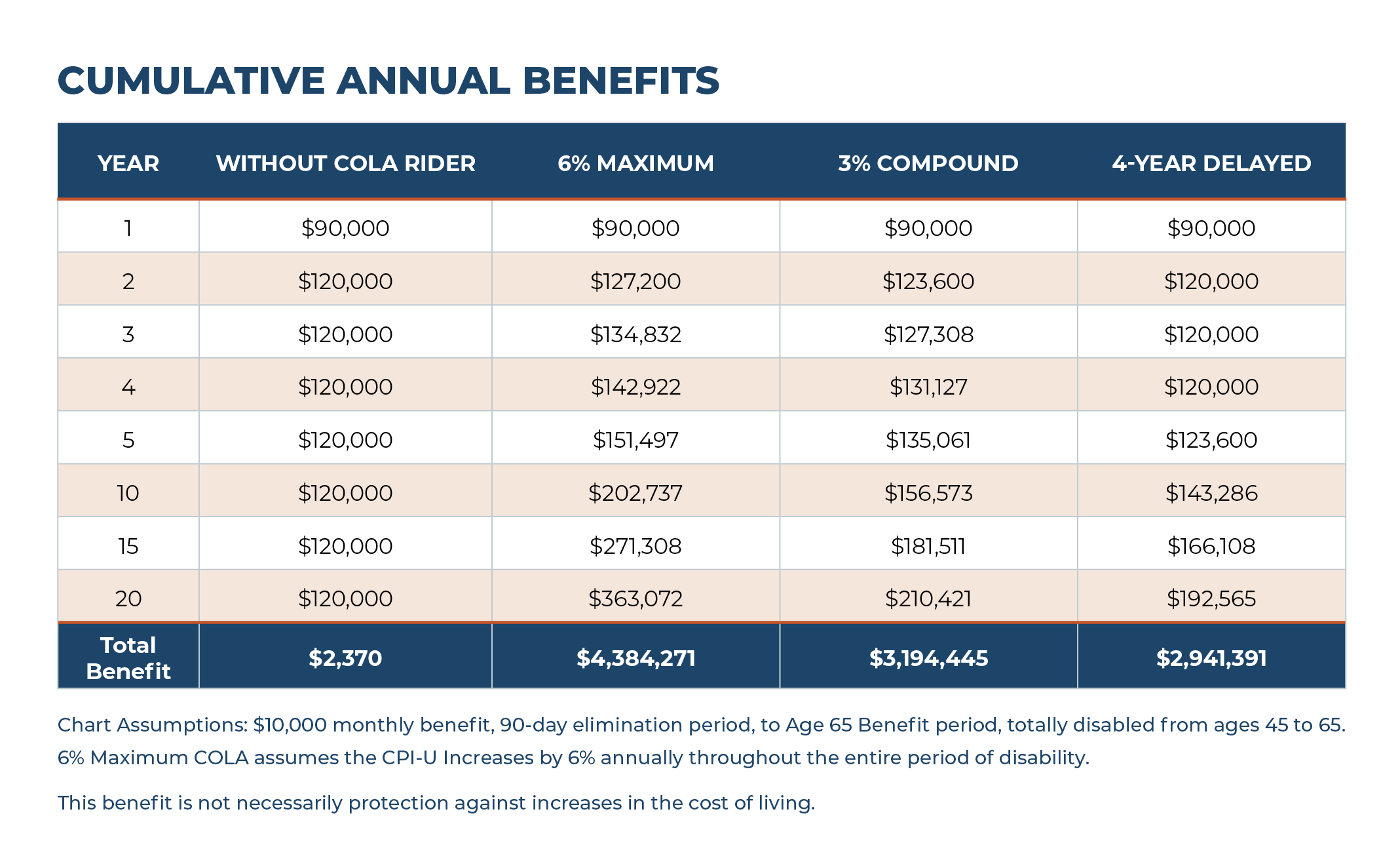

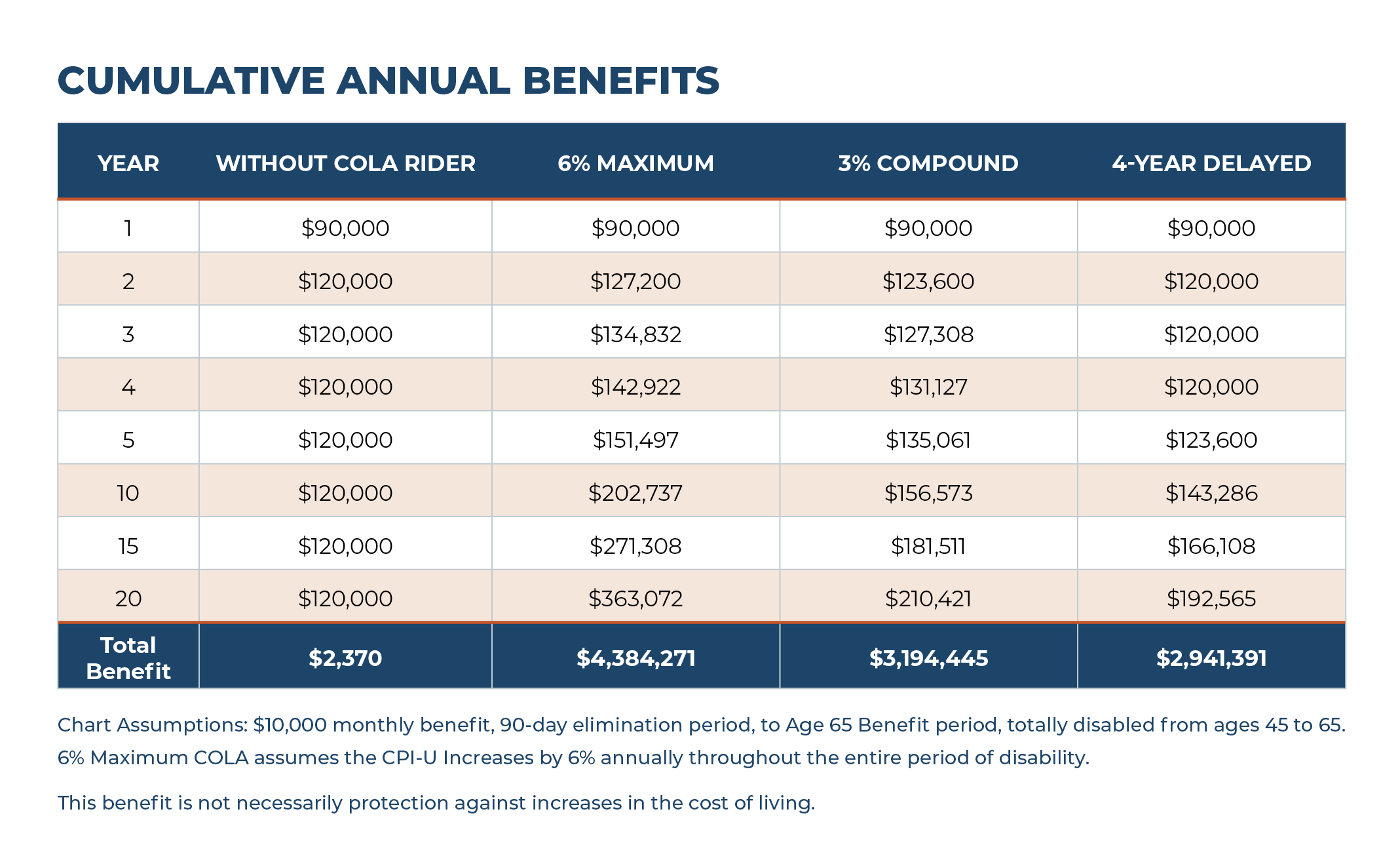

Cost of Living Adjustment (COLA)

Feature value:

It can significantly increase benefits during a disability.

How this feature works to protect you:

During a disability, fixed-dollar benefits won’t keep pace with inflation. That is why a Cost of Living Adjustment (COLA) Rider provides an important benefit. We offer three different COLA rider options that adjust your policy’s monthly benefit annually to help keep pace with inflation during a disability.

Each of these riders is designed to adjust your monthly benefit, whether you’re totally or partially disabled, and includes annual adjustments and a minimum benefit adjustment of 3%, calculated on a compounded basis. There are no limits to the number of annual adjustments made on your policy before the end of your policy. Should you recover, you automatically retain increases, free of charge, until the policy ends, provided that the increase is $300 or more.

Choose one:

- 6% Maximum: After you’ve been disabled for 12 months, we’ll adjust your monthly benefit each year, according to changes in the Consumer Price Index for Urban Consumers (CPI-U). Compounded increases will be no lower than 3% compounded and no higher than 6%.

- 3% Compound: After you’ve been disabled for 12 months, we’ll increase your monthly benefit each year by 3%, compounded annually.

- 4-Year Delayed Increases begin on the fourth anniversary of the date you originally became disabled. We’ll increase your monthly benefit each year by 3%, compounded annually.

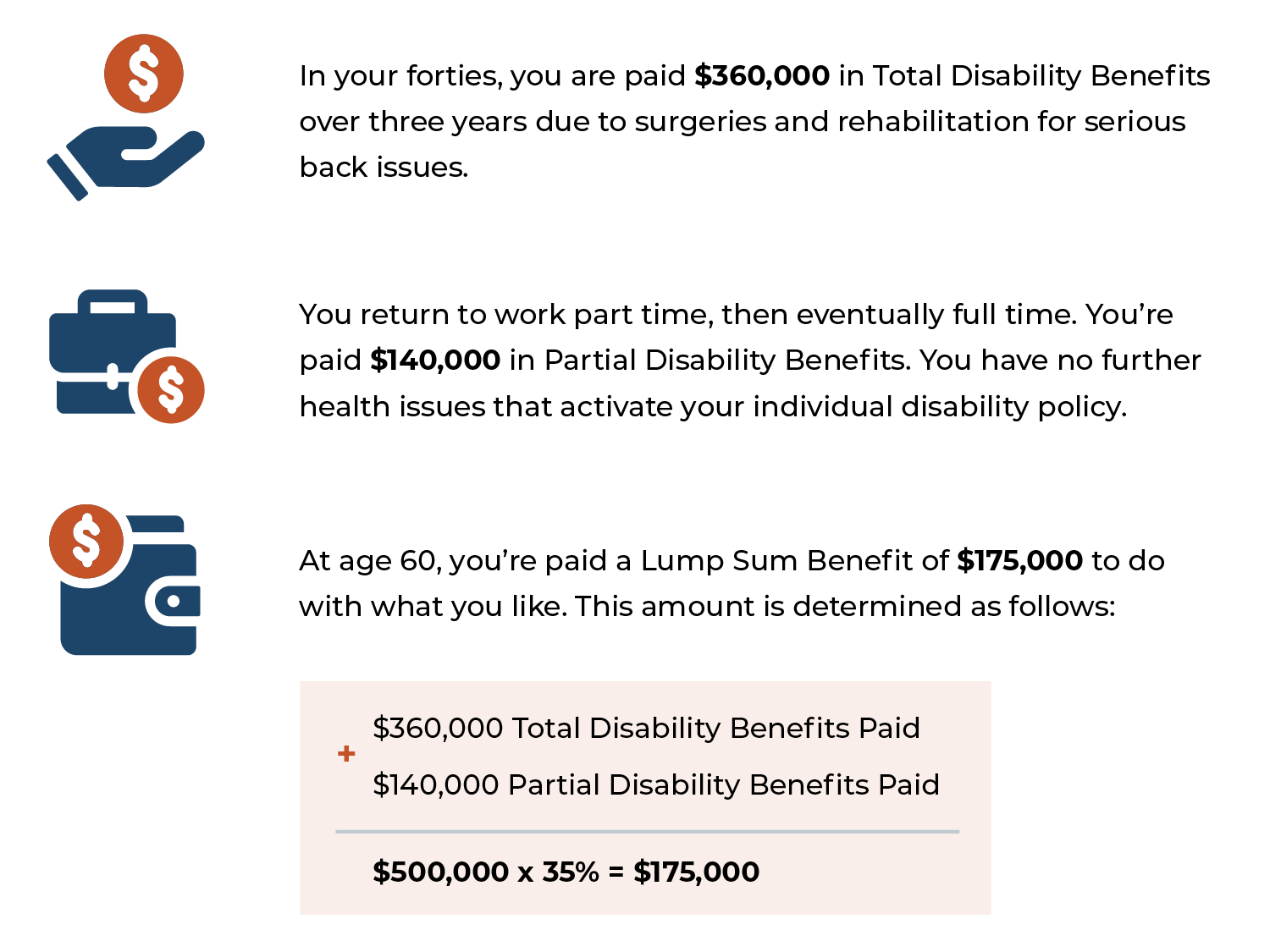

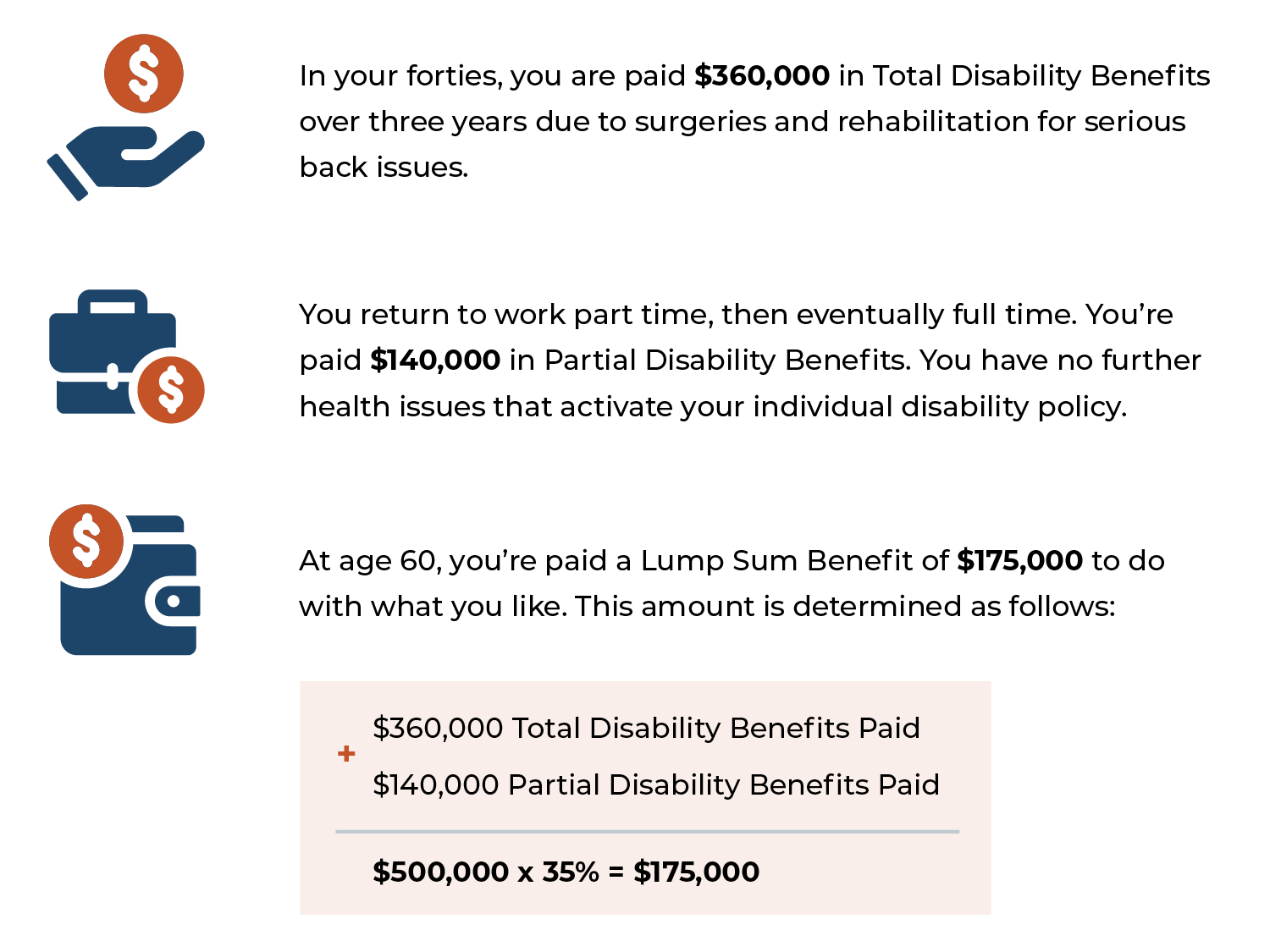

Lump-Sum Disability Benefit

Feature value:

Helps recover for lost “accumulation years” due to disability — this is not available anywhere else in the industry!

How this feature works to protect you:

A period of disability during prime earning years impacts finances in two ways — it affects your ability to pay your day-to-day living expenses and it impacts your ability to save for future plans, such as retirement or a child’s college education.

Our Lump Sum Disability Benefit is designed to give you the maximum flexibility to use a lump-sum amount of money at age 60 to plan the next phase of your life. So, whether you decide to use it to buy a business, buy a fixed income annuity to supplement your retirement savings, or keep as a legacy for your heirs, this benefit can be used however you deem necessary. Best of all, you don’t have to be disabled at age 60 to qualify.

How it works:

The benefit is equal to 35% of all Total and Partial Disability Benefits paid until age 60. (The sum of the Total and/or Partial Disability Benefits paid over the life of the policy must be equal to or greater than 12 times the policy’s monthly benefit for a Lump Sum benefit to be payable.)

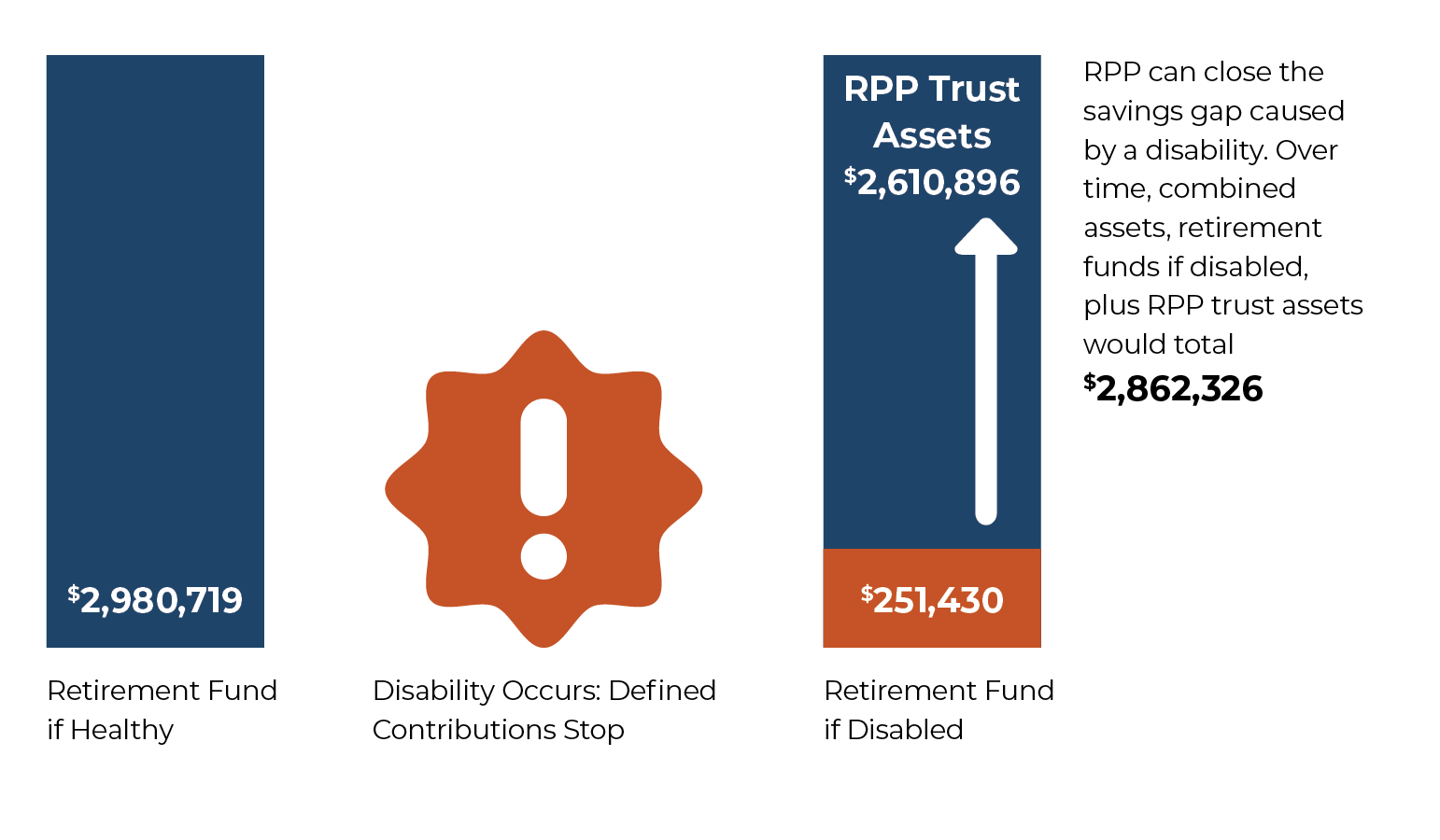

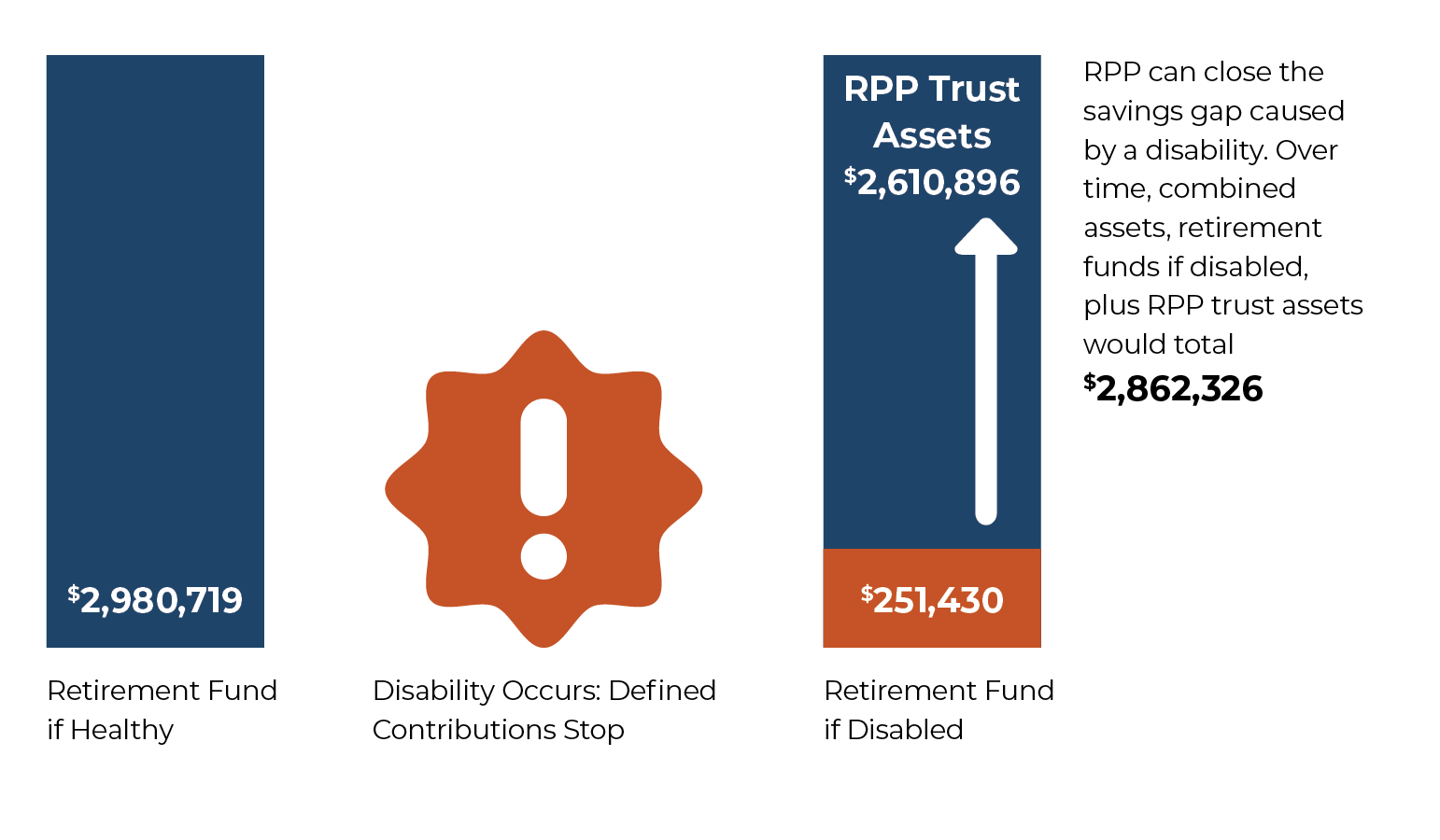

Retirement Protection Plus (RPP)

Feature value:

Helps maintain a healthy retirement strategy

Retirement plans are one of the most important benefits an employee can use to create a healthy retirement income. However, should an employee become too sick or injured to work, generally all retirement saving stops — because neither the employee nor the employer can make contributions if the employee is not actively at work.

Replaces contributions (and matches!)

RPP helps mitigate this risk by replacing the contributions you would have made to a defined contribution plan while totally disabled. A monthly benefit insuring up to 100% of your retirement plan contributions, including any employer match, will be paid into a trust established for your benefit. You establish an investment strategy for the trust and you can begin accessing benefits at age 65.

How it works

See the difference between how retirement contributions would fare with and without an interruption of contributions.

See the difference between how retirement contributions would fare with and without an interruption of contributions.

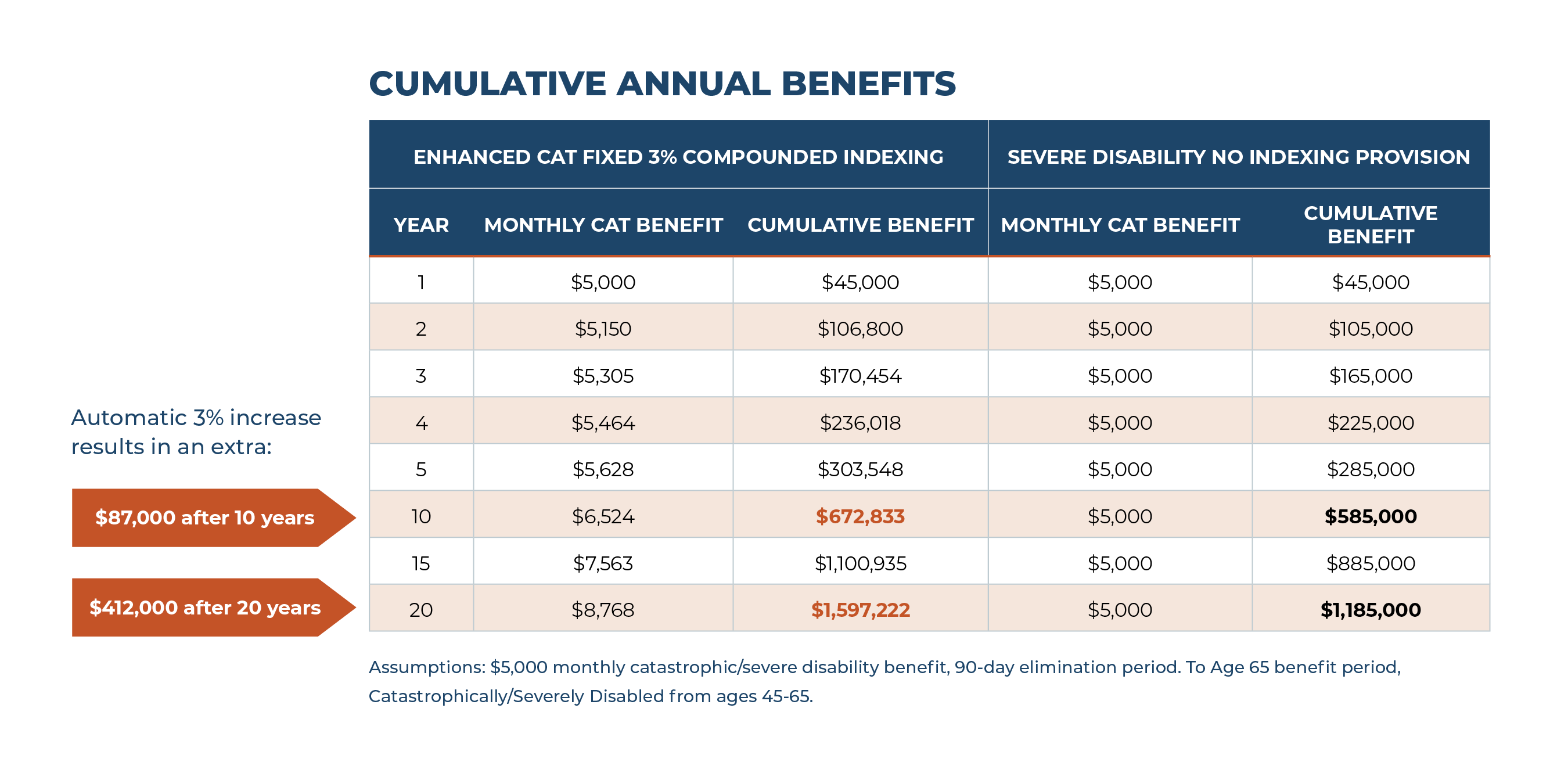

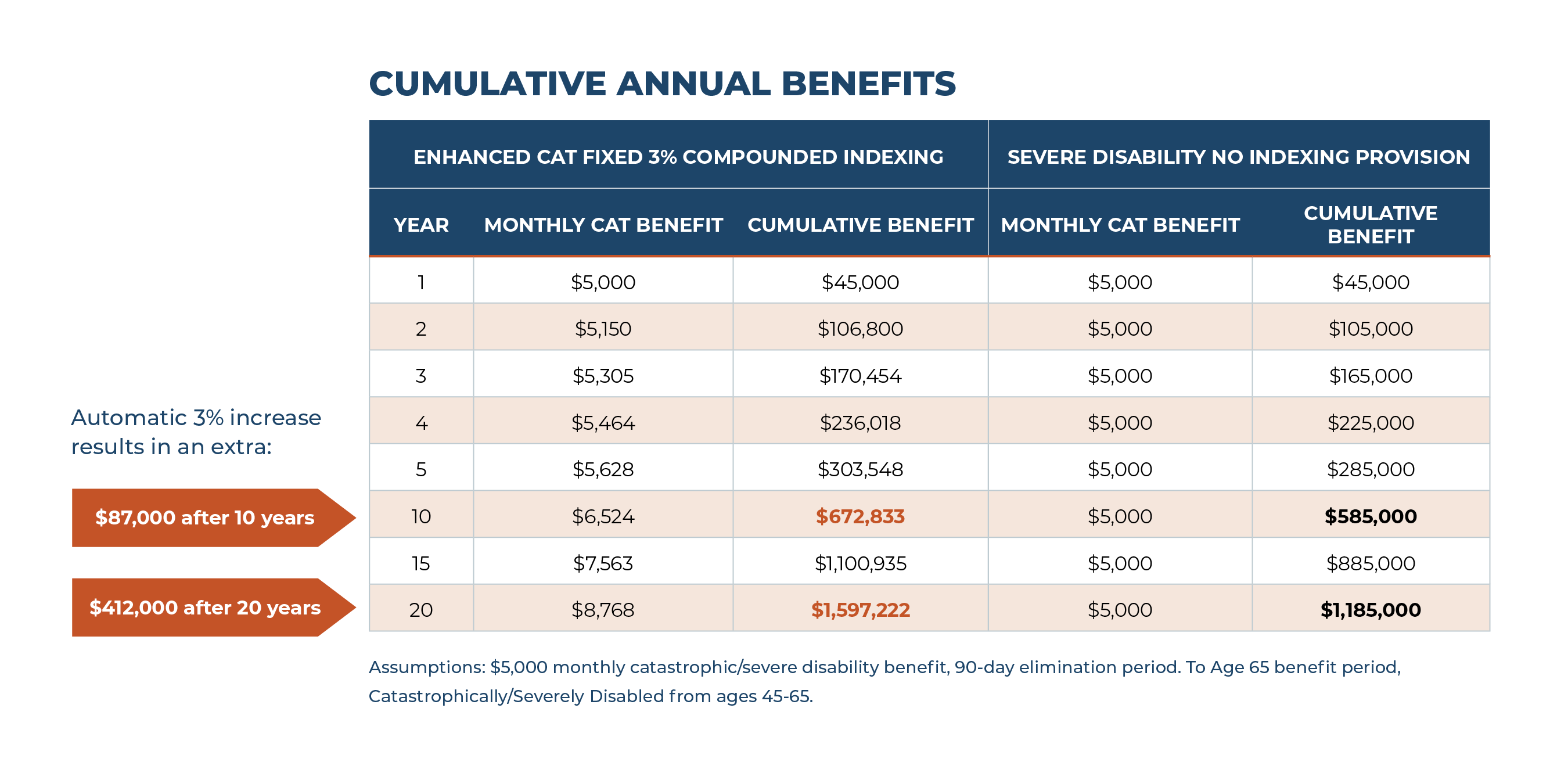

Catastrophic Disability Benefits (CAT)

Feature value:

Provides extra funds during severe illness or injury.

A devastating illness or accident can leave you needing extra assistance. CAT provides extra funds so you’ll have the flexibility to do things such as hire home health assistance or pay for items not covered by your health insurance.

There are two CAT disability benefit choices to choose from. Both offer flexibility and convenience to access extra funds during a severe illness or injury.

Choose one:

• Severe Disability

- It provides extra funds if you are functionally impaired or irrecoverably disabled and may provide up to 100% income replacement when combined with the base policy benefit and other disability coverage.

• Enhanced CAT

• Enhanced CAT

- It provides extra funds if you are catastrophically disabled and may provide up to 100% income replacement when combined with the base policy benefit and other disability coverage.

- Includes an automatic 3% compound cost of living adjustment.

- May also provide benefits if you cannot perform two or more Activities of Daily Living (ADLs), are cognitively impaired or irrecoverably disabled.

Personalize Your Policy

Supplemental Benefit Term Rider

Early in your career, you may be burdened with higher levels of debt and a lower income stream creating a period of high risk. This term-based* option will help protect that area of exposure by providing an additional benefit during a period of total disability on top of the benefit you would normally receive from your base policy. This option provides an extra level of protection to help with unexpected expenses, paying down debt, and saving for retirement.

Social Insurance Substitute Rider

This monthly benefit coordinates with payments received under Social Security and some other government programs. This option is sometimes purchased in lieu of additional base policy coverage to reduce the overall cost of your policy.

If legislated benefits are paid in excess of the Social Insurance Substitute Rider benefit amount, no Social Insurance benefit will be paid. In New York and New Jersey only, the Social Insurance Substitute Indemnity is payable only if you are not receiving any legislated benefits.

Unemployment Waiver of Premium Rider

Should you ever find yourself unemployed and receiving unemployment benefits, this option helps by waiving your premiums for 12 months. It helps you maintain your coverage during a period of unemployment.

Automatic Benefit Enhancement Rider

This convenient rider helps keep your disability benefit aligned with normal, annual income increases you might experience when healthy. It’s applied at underwriter discretion to eligible policies and provides an annual 4% benefit increase each year for six years, with no proof of income required. While there’s no premium charged for this rider, each increase will include an additional premium based on your then-current age.

Mental and/or Substance-Related Disorders1

Unlike most other carriers, we offer coverage with no limit on the duration of benefits for conditions such as depression or anxiety and alcohol or drug abuse. If you choose to have a limit on such coverage, we provide a discount on your premiums.

1 Policies issued to anesthesiologists/anesthetists, emergency room physicians, dentists (general) and pain management physicians, as well as all policies issued in California, will have a mandatory Mental and/or Substance- Related Disorder (MSRD) limitation. For increase options exercised from such policies, the MSRD limitation will also be included. However, a policy may have been issued without the MSRD limitation; in that event, a new policy issued as a result of an increase option exercise is not required to have the MSRD limitation. Discounts are applied when there is an MSRD limitation.

Delivers more benefits sooner and for a longer duration than most in the industry

Delivers more benefits sooner and for a longer duration than most in the industry

Feature value:

Feature value:

See the difference between how retirement contributions would fare with and without an interruption of contributions.

See the difference between how retirement contributions would fare with and without an interruption of contributions. • Enhanced CAT

• Enhanced CAT