Two Types of Partial Disability Riders

Basic Partial

The basic partial disability benefit rider pays you if you have a loss of income in your occupation of 20% or more as a result of the accident or illness that caused the disability. You must also have a loss of either time or duties in your job in order to qualify. This means that, in addition to the loss of income of at least 20%, you also need to be working fewer hours, or be unable to do all the duties you did pre-disability.

Once you’ve qualified for partial disability, benefits are payable in proportion to your loss of income up to the maximum monthly policy benefit. If your loss of income becomes more than 75% of your pre-disability income, then you’d receive 100% of your monthly benefit. Furthermore, for the first six months, under the basic partial disability rider, at least 50% of your monthly benefit is payable, even if your loss of income is not that high.

The basic partial disability rider is a good option for people who have salary positions and are not business owners or who work on commission.

Enhanced Partial

The enhanced partial disability benefit rider is a more comprehensive feature and is designed for those professionals and business owners who have a fee-for-service compensation.

Like the basic rider, the enhanced partial benefit is payable after a loss of income has occurred that was related to the accident or illness that caused the disability. Unlike the basic rider, the enhanced partial rider only needs a loss of income of 15% to trigger benefit payments. Once you’ve qualified for enhanced partial benefits, the payment is slightly different than under the basic partial rider.

- For the first 12 months, the benefit is equal to the actual loss of income-- up to 100% of your monthly benefit.

- After 12 months, benefits are paid in proportion to your income loss.

- If the loss of income is more than 75% of your prior income in any month, they consider the loss to be 100%.

- Even after you fully recover and return to work full time, benefits will continue to be paid as long as you have a loss of income of at least 15% of your prior income and the loss is solely the result of the injury or illness that caused the disability.

The enhanced partial disability rider differs in a couple of important ways from the basic partial.

- The threshold for loss of income is lower at 15% vs. 20%, so benefits are payable sooner.

- During your first year of a claim, you could receive your full monthly benefit, as long as that monthly benefit plus your working income didn’t exceed your pre-disability income.

For example, let’s say you make $100,000 per year and have a disability policy with a $5000 per month benefit ($60,000 per year). You have a partial disability and are working fewer hours, and therefore have a loss of income of $60,000. Under the enhanced partial rider, you’d receive the full $5000 per month to go along with your $40,000 post-disability income. In effect, you’d be “made whole” financially for the first year.

Finally, the enhanced partial rider provides something very important and unique-- a recovery benefit. A recovery benefit is when you recover physically from your disability, but not financially. A business owner, or fee-for-service professional, may suffer a disability and recover from it physically, but still have a lengthy period of financial recovery while they rebuild their business. During this time, as long as there remains a 15% loss of income, partial disability benefits will still be payable, even though this person isn’t suffering a loss of time or duties in their occupation.

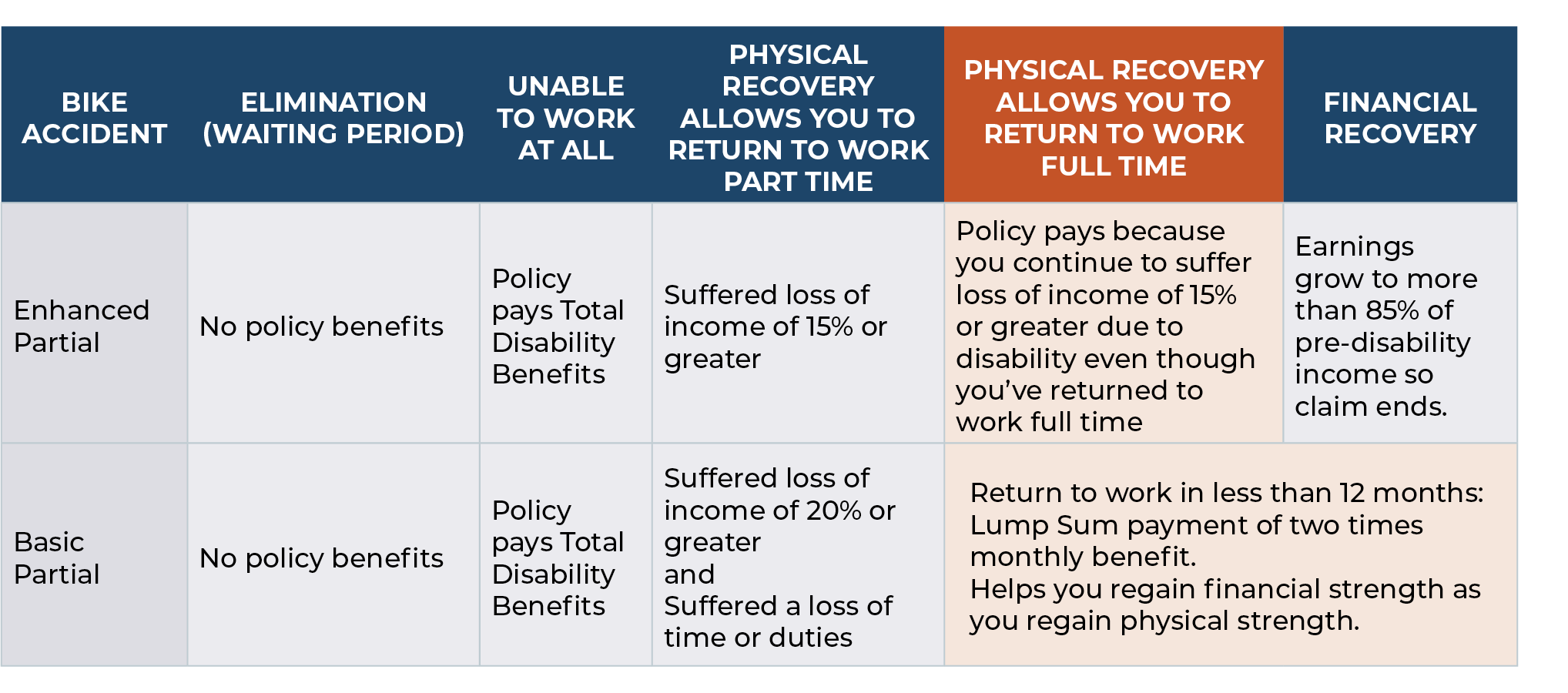

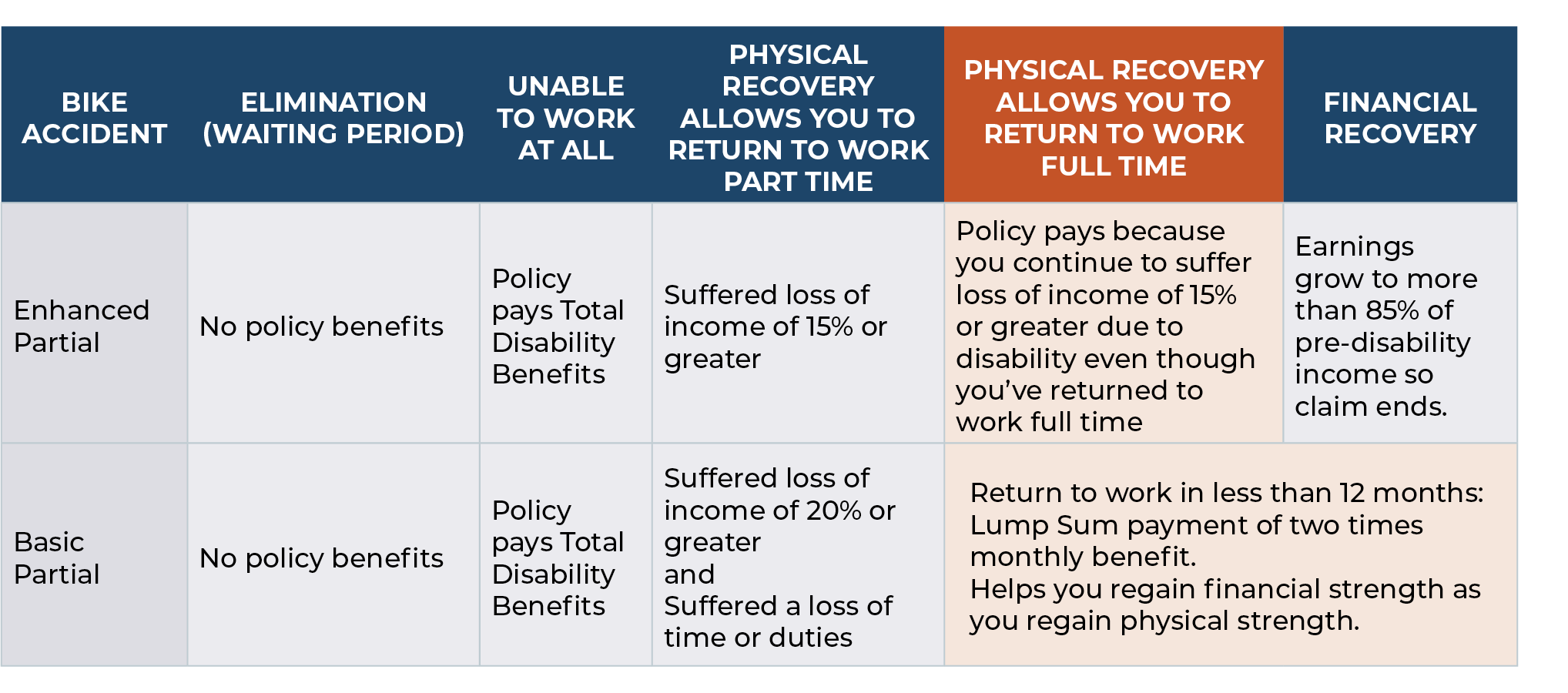

Here’s an example of how the basic and the enhanced partial disability benefits work in a claim:

There are many important aspects to consider when looking into a disability insurance policy: own occupation coverage, getting a policy that is non-cancelable, and securing the correct type of partial disability insurance benefits. However, the first place I recommend you start is with making sure that you have the best partial disability coverage you can find.

Individual disability income products are underwritten and issued by Berkshire Life Insurance Company of America, Pittsfield, MA, a wholly-owned stock subsidiary of The Guardian Life Insurance Company of America (Guardian), New York, or provided by Guardian. Product provisions and availability may vary by state. Optional riders are available for an additional premium.

This material contains the current opinions of the author but not necessarily those of Guardian or its subsidiaries and such opinions are subject to change without notice.